Nithin Kumar Reddy

Mar 28, 2025

Nithin Kumar Reddy

Mar 28, 2025

The finance industry is booming, and there are more careers than ever in this field. There has been much change with the emergence of new technologies, so it is essential to work on financial reports quickly and efficiently. To succeed in your career as a finance professional, you need specific skills to make you stand out from others.

For many people, the finance industry is a desired career path. It is an exciting field that offers many opportunities to those who have what it takes. However, not everyone can succeed in finance just by being firm with numbers and making good decisions. Soft skills are also required for this type of work and hard skills to help you succeed in your career.

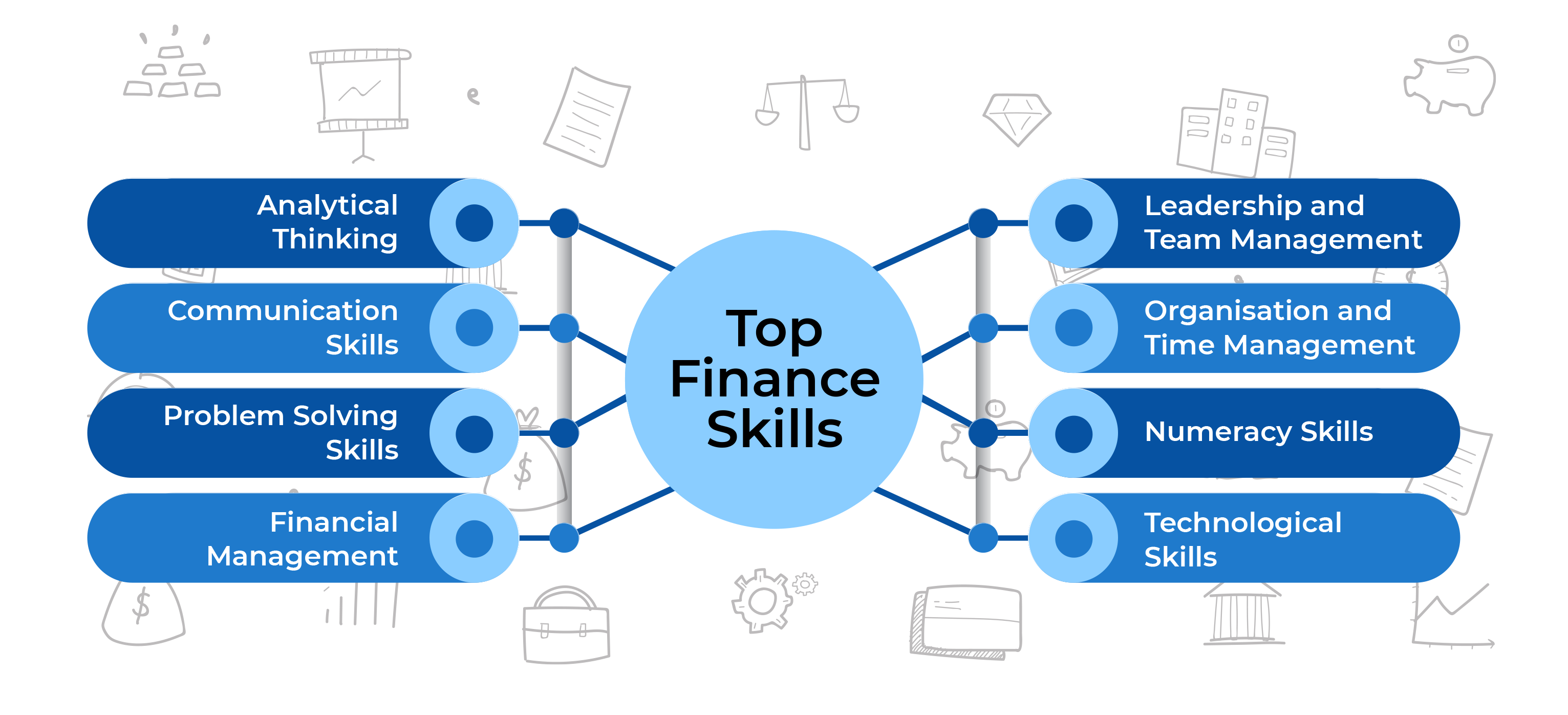

To better understand how cardinal and essential finance soft skills and hard skills are to excel in your career, we shall discuss the top 8 skills for finance careers. We will also learn how to improve those skills so that they can match up with your strengths.

Read Also: Top Finance Certifications

There are many different routes into the field of finance. You need to have strong analytical and communication skills, and know-how technology can enhance your productivity. However, there is so much more to finance and require specific skills to master in the field. Here are some of the top finance skills that you can build to enhance your performance.

Analytical thinking is a crucial skill for finance professionals. It refers to looking at and understanding the situation, interpreting it and deriving an intelligent response as quickly as possible as a financial professional; solving problems is an everyday activity that arises from technical ones to interpersonal issues with clients or co-workers.

When analytical skills combined with problem-solving are your forté, there is no obstacle too tall when developing intelligent solutions on how best to resolve them swiftly. It would greatly benefit yourself and the company itself because of all the time saved by coming up with such quick resolutions, making you a valuable asset.

Some of the areas of finance where analytical thinking is a crucial skill are financial analysis, risk analysis, risk management, strategic financial planning, and data analysis.

Read Also: Why SAP FICO Certification is important for a Career in Financial Management

When you work in the finance sector, how well you can communicate is of utmost importance. In this industry, there are many chances for miscommunication and misunderstandings to happen without solid communication skills. Moreover, it becomes challenging to share insights or collaborate with other people on projects if your vocabulary is insufficient.

No matter what industry you are talking about, expressing yourself clearly and concisely is crucial because communication can often be challenging without good speaking abilities.

Read Also: How to Speak English Fluently and Confidently?

Those in finance roles might be tasked with reacting to financial problems within a company. For example, you may have to find a way of paying off liabilities using available assets and other methods like negotiating different loans or restructuring contracts to make them more manageable for the organisation.

For a career in finance, employee's are expected to be problem solvers. They face complex problems like financial dilemmas and tax issues that come up all the time in business. Employers look for employees who can tackle these challenges head-on until they get resolved. So, it is essential to make sure you know systems and processes and skills when tackling a challenging project or dilemma at hand.

Read Also: How to Improve Your Soft Skills

Financial Management refers to managing a company's resources and ensuring they are being used most efficiently. It also relates to understanding general business principles when financing and acquiring loans or other forms of debt for funding when funds from operations may not be enough.

Financial Management involves many critical steps like organising, planning, directing and controlling economic activities so that you can procure money for your organisation's future growth. Moreover, it focuses on applying general managerial concepts concerning financing, related explicitly to budgeting expenses, income, balancing assets and liabilities, etc.

Read Also: Roles And Responsibilities of A Finance Manager

With leadership and motivation, even those in entry-level positions will set themselves apart from their peers by taking a proactive approach to projects and teamwork. From general project management to spearheading team activities, these are skills any financial professional should have on hand.

The most coveted and respected financial professionals know how to motivate themselves to make sure any task at hand gets done without fail. Leadership demands that you guide a team in such a way that it does its best work. In many ways, leadership is like teamwork. It involves teaching your teammates to do their best work. Nevertheless, it also requires sound judgment over them and an insistence upon hearing their thoughts.

Read Also: Effective Leadership Training Activities For Employees

Organisational skills and time management go hand-in-hand. Organisational skills are about making the most of your time, leading to reaching a specific goal or completing a task in proper order. With efficient organisation, you can optimally utilise your time to bring effectual output.

Numeracy is essential to understanding numerical content and being able to use statistical skills appropriately. I may sound obvious, but having solid mathematical skills will benefit your financial career. Numeracy skills are significant for all financial roles. For example, financial analysis, predictive analysis, data management, and accounting are vital roles in finance that require numerical skills. If you have the talent to understand most mathematical concepts, it will be easier to develop analytical skills.

Financial professionals must now come to terms with the fact that their occupation is transitioning into an era of tech. Mainly, financial institutions rely on technology to manage workflows more efficiently and improve profit margins by streamlining time-consuming processes like trade execution. With this being said, finance professionals need to learn about new technologies used in business practices.

Read Also: Benefits of Finance Certification

Sometimes, developing a new skill can be pretty challenging. However, once you begin your journey and choose the proper milestones, it will become easier to learn as time progresses and more gratifying. The key is to identify what career goals you want so that, in turn, you will know how far along your path of development. Once you have your plan set on being accomplished, nothing can stop you from getting there.

Developing any skill set requires persistence and dedication. However, the following tips can help you improve your financial skills:

One step to improving your finances is identifying areas where you have low experience. Then, if it feels like a struggle for you, focus on mastering the necessary skills and tackling other issues as they arise or when opportunities present themselves.

If you are not comfortable using computer software programs, consider working toward a mastery of this skill. Once confident in using computer software within your job, look to other areas that may be challenging for you and continue learning from there.

Certification is a great way to improve financial skills and can serve as an enhancer for your resume. Therefore, it is essential to find the proper certification for your experience level and career goals to be successful. Accounting professionals can find more opportunities in any part of the world with IFRS Certification if the same accounting practices prevail everywhere

Industry certifications can be a powerful resume enhancer and knowledge demonstrator for crucial finance principles. Therefore, it is essential to understand which skills you need from the certification to ensure that it will improve these areas for you.

Read Also: Accounting vs Finance: Which One's Right for You?

Financial skills, such as keeping track of expenses and developing budgets, can be applied to your daily life. It will help you better assess how stable your financial future is based on your habits today. Furthermore, interest in a finance position at work or outside of work will increase this skill set.

Financial skills are helpful for all areas of our lives because they apply in our homes and business scenarios like creating budgets and assessing one's stability from spending patterns. People who take time out of their day-to-day routines to practice these sorts of things are much better prepared than those who do not know anything about finances.

Read Also: Top Accounting Skills

If you have not yet mastered any skill or identified their skills, can do so by the following points:

Read Also: High Paying Accounting Careers

Read Also: How CMA Certification Can Help to Build Your Accounting Career?

To Sum Up

In finance, the soft and hard skills you have in your hands can make or break your prospects. So it is essential to identify what you possess so far and where there are gaps. It may take a bit of time to build new skills from scratch, but you will be equipped with an edge over other applicants for jobs in this field if all goes well.

Read Also: Advantages of An Accounting Career

Accounting and Finance Trainer

Nithin Kumar Reddy is an Accounting and Finance Trainer with over 8 years of experience in finance and accounting training. His expertise includes IPSAS, IFRS Consultation, Implementation, Auditing, and Public Accounting. He is a qualified professional, holding credentials as a Chartered Accountant and a Public Accountant.

Nithin is a member of the Institute of Chartered Accountants of India (ICAI), the Chartered Institute of Public Finance and Accountancy (CIPFA), and the Association of Certified Fraud Examiners (ACFE). He has also earned diplomas in IFRS and Public Financial Management (PFM) certifications.

As a corporate trainer, Nithin Kumar has successfully conducted training sessions for clients in IFRS, IPSAS, and PFM implementations, corporate tax, auditing, financial systems, and cost management. His corporate training portfolio spans the Asia-Pacific, Middle East, and Africa. Nithin is renowned for his deep knowledge, engaging teaching style, and unique ability to simplify complex financial concepts. During his training career, Nithin has successfully trained over 1,000 finance professionals.