Asim Nath Dubey

Apr 01, 2025

Asim Nath Dubey

Apr 01, 2025

Pursuing a career as an accountant is a wise decision because there is expected to be strong industry growth, a high median compensation, and a demand for qualified accounting professionals. However, after you’ve decided to pursue a career in accounting, you’ll find that the profession is much wider and more diversified than you would have imagined, with opportunities to use your abilities in various areas.

The breadth of the accounting field may surprise many people thinking about it. You can learn more about the two main career routes accountants choose in this article: public accounting and private accounting. There are specialities and alternative career paths you can consider after deciding on the workplace that best fits your talents, interests, and ambitions. Read on to discover how to select the ideal accounting career path. The advantages of a career in accounting are numerous because it ensures rapid advancement and is constantly in demand.

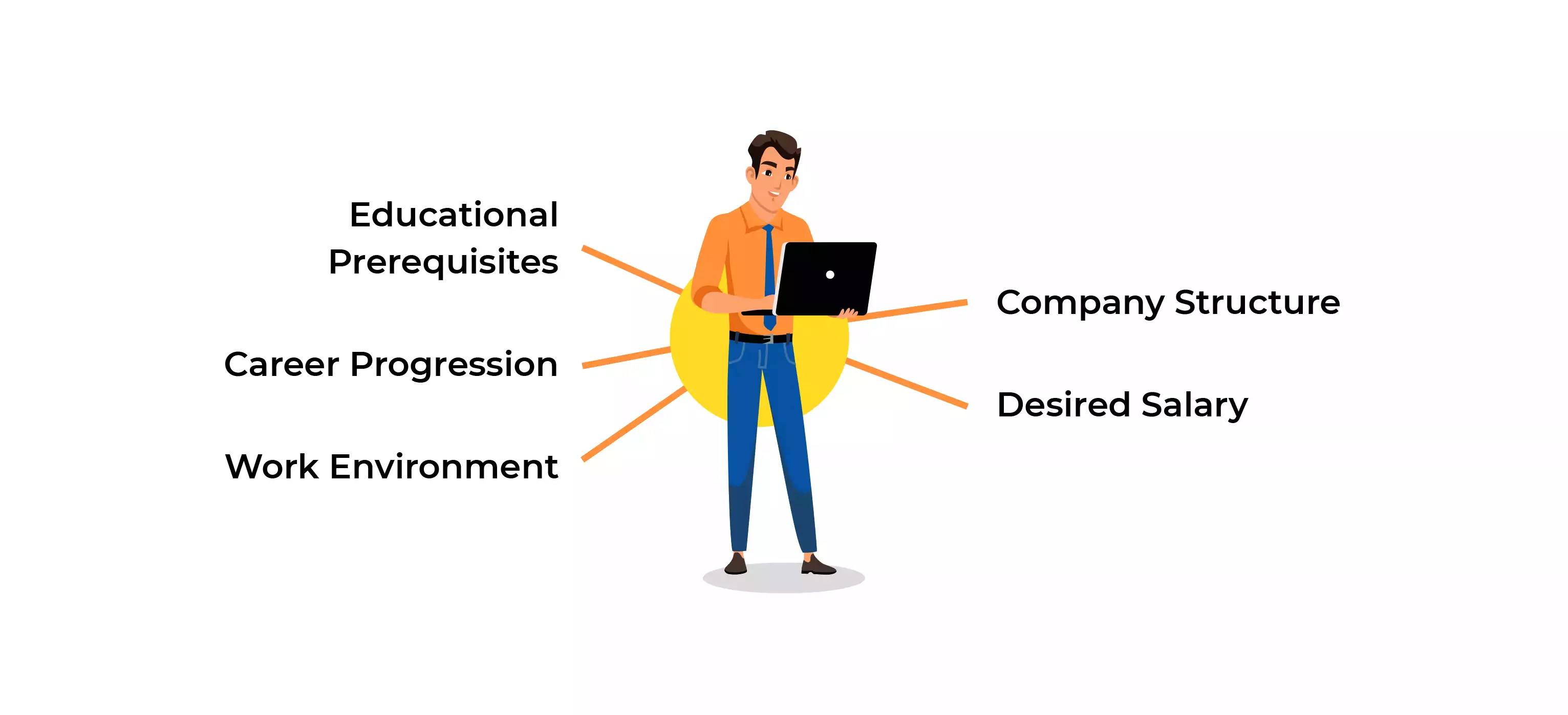

Making recommendations to accounting teams, introducing new accounting procedures, or putting financial software systems into place are all possible parts of your job. Technical accounting might offer a fantastic profession if you enjoy technology. What more qualities do you require, then? Here are some factors to consider when choosing a career in accounting:

Having a bachelor’s degree in accounting or a closely related discipline is an added point if you want to start a career as an accountant. Your preparation for entry-level accounting work in various businesses can be enhanced by earning a four-year degree from an approved university.

You can also pursue a career in accounting after pursuing finance and accounting courses certification from a qualified institution. For example, going for the CMA certification is a great career move and will help you stand out from the rest of the accountants. You can do corporate and public accounting across different positions like planners, analysts, managers & auditors. The CMA course can help you get a better entry-level position in various companies and open doors for promotion.

You May Also Like: How to Prepare for an Accounting Career?

A career in accounting can offer good job security and opportunities for progression. Career progression in accounting depends on a number of factors. Proper education and experience in the field can help you progress in your career. Many accounting firms offer entry-level positions that provide on-the-job training, which can be a great way to start your career. Once you have the education and experience required for an accounting position, there are several ways to advance your career. Having skills in using accounting tools such as tally, QuickBooks, Zoho Books, Xero, Peachtree, and more can also help you in achieving career progression.

Check Out: Top Accounting Skills to Include on Your Resume

When choosing the right accounting career path, consider your skills and strengths. Do you have strong analytical skills? Are you detail-oriented and able to maintain focus even when working on long and complex projects? If so, public or corporate accounting could be a good match for you. Alternatively, if you’re more creative and enjoy developing new ideas and solutions, then corporate finance or investment banking might be a better fit. Recognising your strength and weakness can help in climbing the career ladder easily. The odds of having a competitive edge over your rivals will be maximised by diversifying your best accounting skills in numerous finance-specific automation solutions.

Give priority to what interests you when deciding on your career path. For instance, do you enjoy working with numbers and analysing financial data? Or do you prefer communicating with clients and providing them with advice? Many accounting roles cater to other interests, so it’s essential to understand what you enjoy doing before deciding.

You can become certified as a public accountant or a certified fraud examiner or specialise in a particular area of accounting, such as tax accounting or auditing. There are also many management positions available in accounting, which can lead to even higher levels of responsibility and compensation. With the right education and experience, there are many opportunities for career progression in accounting. You can also choose to become an accounting auditor with certified accounting training.

Accountants often operate in an office environment in businesses ranging from major corporations to small companies with a small staff. An independent contractor or self-employed CPA can work in a flexible setting. The daily speed of an accountant’s workload is also part of their environment.

Seasons of extreme workload for some jobs, like tax accountants, increase and fall with the due dates for filing tax returns. Due to their financial reporting and consulting responsibilities, management accountants who work internally for major organisations may find their workload incessantly hectic.

Also read, Accounting vs Finance: Which One’s Right for You?

Nearly all business sizes, from tiny to large, in all industries, require accountants. Therefore, it is up to you to choose the location where you feel most comfortable. Consider your career objectives: Would you like to be on the accounting staff of a for-profit business or private corporation where you would work with a variety of clients?

Your ability to work for different companies will also depend on your interest in particular account fields. For example, if internal audits are your thing, you probably need to look at more prominent companies. If you’re self-employed, you might succeed as a financial consultant.

What aspects of your pay should you consider when choosing a career? While picking a profession you enjoy is crucial, you also want to be sure you can support yourself financially. When choosing a career path in accounting, your desired salary structure is important.

Your salary will be based on your experience, education, and skillset. It is important to balance what you are worth and what the market will pay for your services. Research salaries before you seek a job position and try to negotiate for the best possible compensation. Your future earning potential is important to consider when making any career choice.

Read More: Accounting Career Outlook and Salary Structure

So, you’ve decided to pursue a career in accounting. But with so many accounting roles out there, how do you know which one is right for you? This blog will remind you of a few things to consider when choosing an accounting career path. Choosing a career may be based on several important aspects according to your priority scale.

Ultimately, choosing the right accounting career path is a personal decision that should be based on your specific goals and preferences. With careful consideration, you can find the perfect fit for your unique skills and interests.

Also read, How CMA Certification Help to Build Your Accounting Career?

Explore the Accounting & Finance Courses Offered By Edoxi Training Institute in various countries and locations in the Middle East.

| Country | UAE | Qatar |

| Course Location | Dubai | Doha |