Edoxi’s 120-hour Certified Management Accountant (CMA) training in Kuwait builds advanced expertise in management accounting, financial analysis, strategic planning, and decision-making. It is designed for finance professionals seeking global CMA certification and leadership roles in accounting and financial management. The CMA course is delivered through classroom, live online, and customised corporate training formats to suit individual and organisational needs.

Our CMA curriculum comprehensively covers external financial reporting, budgeting and forecasting, performance management, cost management, internal controls, risk management, technology, and analytics. Participants gain practical exposure through exam-focused problem-solving sessions, case studies, essay simulations, and multiple-choice practice aligned with IMA exam standards. The CMA training emphasises real-world financial decision-making and strategic thinking essential for senior finance roles.

The CMA program is ideal for accounting graduates, financial analysts, cost accountants, business managers, entrepreneurs, and aspiring financial leaders. Upon completion of our CMA course, participants receive Edoxi’s Certified Management Accountant course completion certificate. Learners are also fully prepared to clear both parts of the CMA exam and earn a globally recognised certification. The credentials gained after passing the exam support career progression into roles such as Finance Manager, Financial Controller, and CFO across diverse industries.

To know more about CMA course fees, syllabus, and personalised classroom, online, or corporate training schedules, contact Edoxi in Kuwait.

Enrol now to advance your finance career in Kuwait with a globally respected CMA credential.

The Certified Management Accountant (CMA) exam evaluates your expertise in financial planning, analysis, control, decision support, and professional ethics required for advanced management accounting roles. Below is a clear overview of the key CMA exam details:

| Exam Criteria | Details |

| Exam Format | Two parts, 4 hours each (3 hours MCQ + 1-hour essays). |

| Questions | Each part includes 100 multiple-choice questions and 2 essay questions. |

| Passing Score |

Candidates must score 360 out of 500 on Part 1 to proceed to Part 2 and also on Part 2 to earn certification.

|

| Prerequisites | Bachelor's degree or professional qualification and IMA membership. |

| Certification Validity | Lifetime (with ongoing CPE requirements). |

| Recertification | 30 hours annual CPE, including 2 hours of ethics training. |

Access comprehensive CMA study guides, textbooks, mock exams, and robust practice question banks for thorough exam readiness.

Participate in engaging group discussions and practical problem-solving activities to enhance financial analysis and decision-making skills.

Practice CMA-aligned multiple-choice questions and essay simulations designed to reflect actual exam standards.

Utilise professional templates, analytical frameworks, and specialised eBooks to strengthen financial management expertise.

Benefit from focused small-group sessions that provide individual attention and tailored learning support.

Select from classroom or online training options with weekday or weekend sessions to suit your professional commitments.

Ideal for recent graduates and students seeking a globally recognized certification to build a solid foundation in management accounting and financial expertise.

Designed for professionals aiming to enhance their financial leadership capabilities and implement effective strategies for organisational success.

Perfect for business owners looking to adopt advanced financial strategies, improve decision-making, and drive sustainable business growth.

Tailored for analysts wanting to deepen their knowledge of financial analysis and transition into strategic financial management roles.

Suited for professionals specializing in cost management who wish to enhance their skills and unlock greater career opportunities.

For those looking to advance into senior leadership roles in financial management and strategic decision-making within diverse industries.

Our Certified Management Accountant course in Kuwait combines expert-led instruction with practical, exam-focused learning activities aligned to real-world financial and business scenarios. Key learning activities include:

Participate in guided group discussions to analyse and deepen understanding of key financial concepts.

Practise multiple-choice and essay questions structured to match official CMA exam standards.

Engage in practical problem-solving activities to strengthen financial analysis and decision-making capabilities.

Access detailed study guides, mock exams, eBooks, and supplementary resources for complete exam preparation.

By completing our CMA course in Kuwait, you will build advanced financial expertise, enhance strategic decision-making skills, and gain practical knowledge for global finance roles. The key outcomes include:

Get expert assistance in getting your CMA Course customised!

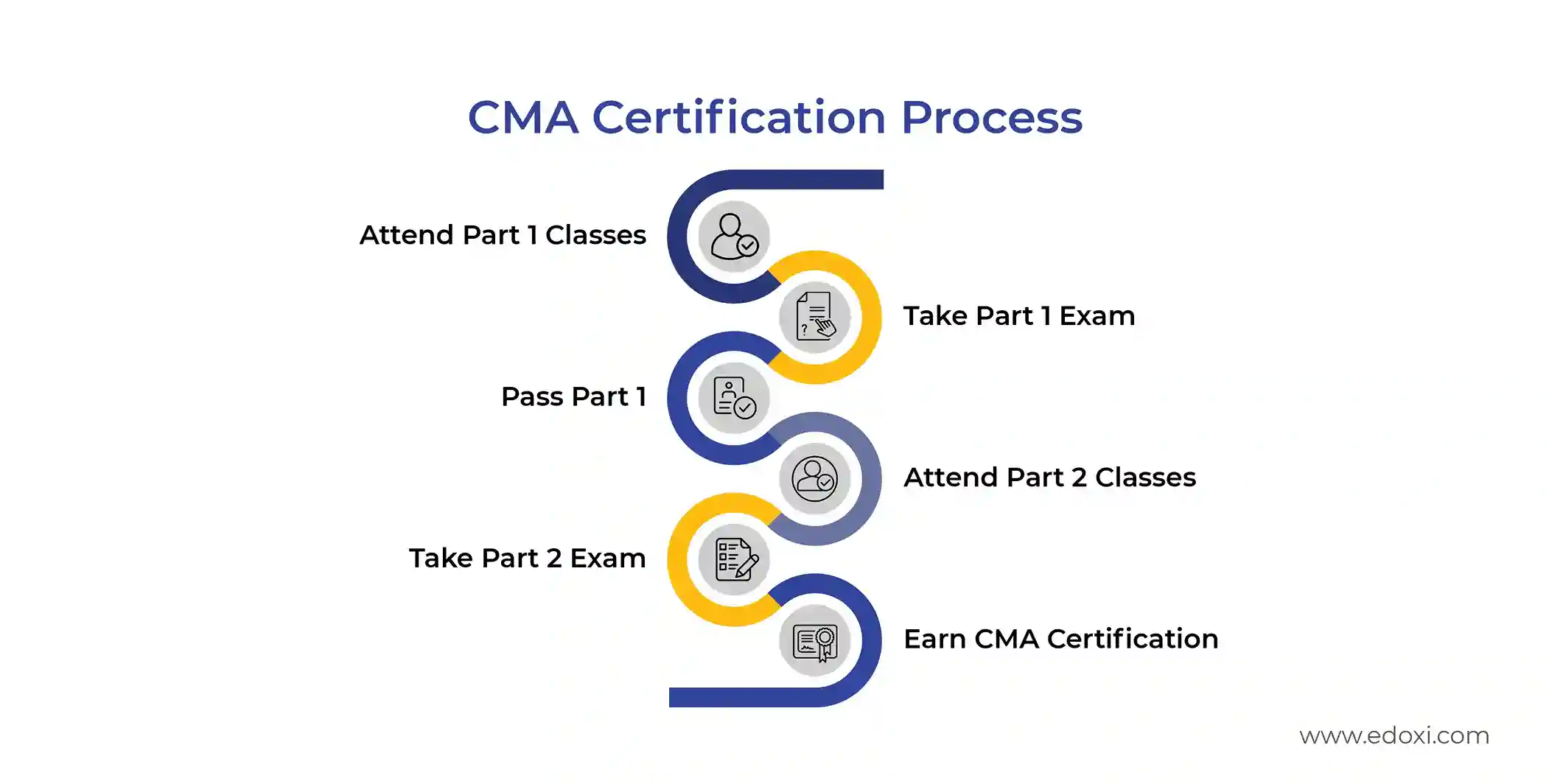

Here’s a four-step guide to becoming a certified CMA professional.

Join Edoxi’s CMA Course

Among the many options available in Kuwait, Edoxi is a standout choice. Here’s why Edoxi’s CMA training is the perfect fit for your needs:

Upon completion of the Certified Management certification course, learners can gain a CMA course completion certificate.

Gain insights from finance professionals who provide practical strategies for mastering CMA exam concepts.

Access detailed study guides, textbooks, mock exams, and test banks for thorough exam preparation.

Small group sizes ensure personalised attention and an engaging learning experience.

Participate in discussions and problem-solving activities that enhance financial analysis and accounting skills.

Weekend classes are designed to help balance professional commitments with effective CMA preparation.

Our mentors are leaders and experts in their fields. They can challenge and guide you on your road to success!

Lahiru Prasanna Silva

Lahiru Prasanna Silva is an expert CMA trainer at Edoxi Training Institute, Dubai. He has over 20 years of practical experience in the finance industry and 18 years of dedicated training expertise.Throughout his career, he has successfully trained more than 20,000 students, equipping them with the skills and knowledge needed to excel in their professional journeys.

His deep understanding of finance and passion for teaching have made him a trusted mentor for aspiring CMA candidates.With a special interest in teaching, Lahiru combines his core expertise in education with his extensive finance background to deliver comprehensive training programs. His commitment to student success ensures that participants gain both theoretical knowledge and practical insights, enabling them to excel in their CMA certification exams and build successful careers in financial management.

Here is the list of other major locations where Edoxi offers CMA Certification Course

It identifies differences between planned and actual performance to uncover inefficiencies and areas for improvement.

ABC assigns costs to products/services based on activities, offering more accurate cost insights for decision-making.

They guide professionals in resolving conflicts, ensuring compliance, and fostering trust and integrity.